The effect of interest rates on the US federal budget

The Effects of Interest Rates on the US federal budget

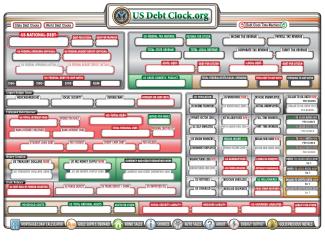

As of 9.29.2022 the following figures existed for the US federal government.

National Debt $30.921 Trillion

Annual Tax Revenue $4.9 Trillion

Annual Expenditures $ 5.9 Trillion

Annual Deficit $1.0 Trillion

That deficit is funded by issuing more debt thus increasing the total National debt by about $1.0 Trillion per year.

The federal expenditures can be broken down as follows:

Medicare $1.471 Trillion

Social Security $1.141 Trillion

Defense $0.759 Trillion

Interest $0.445 Trillion

This means the average yield on the US debt is around 1.4% currently. The current yields on Treasury bills, bonds and notes are in the high 3’s. This would equate to a greater than doubling of the interest expense. This additional expense would require additional borrowing. Obviously even higher rates than today exacerbate this situation.

The federal reserve has been a large buyer of treasury bonds over the last 10 years. They are now indicating that they will be reducing that portfolio. This will add more to the supply side. Foreigners have also recently been reducing their treasury holdings as the need to generate dollars grows.

This situation is tolerable in the short-term, but the higher rates will trickle in parts of the economy that will not be able to tolerate it. Mortgages and car loans are two highly sensitive areas. If the debt service for homes and cars doubles, the principal value could be drop by as much as half. This would cause tremendous stress in those markets.

It will be very difficult for the economy to handle interest rates where they currently are or higher. Significant adjustments in the credit markets would need to occur. The speed of the rise in interest rates means that likelihood that someone is caught offsides is high.